nj bait tax payments

2021 PTE-200-T Extension of Time to File. Until 2022 there is a middle bracket of 912 for income between 1M and 5M.

Tax Guide For Pass Through Entities Mass Gov

Its estimated to save New Jersey business owners 200 to 400 million annually.

. The BAIT is effective for tax years beginning on or after January 1 2020 and is designed to provide an above the line deduction for the pass-through entity. However as t he BAIT enables owners of PTEs to reduce their federal taxable income by remitting this entity-level tax on its New Jersey-sourced income where in 1120S this. When Governor Murphy signed the Pass-Through Business Alternative Income Tax BAIT into law it allowed pass-through entities to elect to pay tax on behalf of the owners share of distributive proceeds.

Covid19njgov Call NJPIES Call Center. Mine is single member SCorp. Hence I need to record it as an expense on my 1040 to offset the income reported on the K-1.

The purpose of this NJ state approved program is to avoid the 10000. 12000 50 of 24K NJ BAIT paid by PTE Payment Due by the Partner. 2021 PTE-100 Tax Return.

15 2022 to June 15 2022. Taxpayers who earn income from pass-through businesses and pay. BAIT allows for owners of pass-through business entities S corporations and partnerships to elect to be taxed at the entity level on their business income for the year.

Pass-Through Business Alternative Income Tax Act. However it is not reported on the 1120-S schedule K-1. Overpayment of the BAIT taxes by pass-through entities can be applied to future estimated taxes or be refunded depending on preference.

So your cash basis taxpayers will need to make their New Jersey BAIT payments by 12-31-20 in order to get their deduction in for the 2020 tax year. Taxpayers who earn income from pass-through businesses and pay. September 3 2021.

PTEs wishing to pay the BAIT will be required to make quarterly estimated. Estimated tax payments are due on April 15 June 15 and September 15 of the tax. Nonresident Withholding The new 2022 BAIT does not require a partnership or LLC taxed as a partnership to withhold New Jersey gross income tax.

Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. Signed into law in January the BAIT is a new elective business tax regime in which New Jersey PTEs partnerships limited liability companies and S corporations can elect to pay an entity-level tax. In addition pass-through entity owners may still need to make NJ-1040-ES estimated tax payments to cover the tax on other income they receive aside from pass-through entity income such as personal.

1418750 652 over. The BAIT election can provide the opportunity for tax savings for those businesses with significant activity in New Jersey. As far as the accrual basis taxpayers theyll accrue their tax as a deduction for 2020 deduction purposes but will have until January 15th 2021 to make their payments for the 2020 tax year.

In order to make a BAIT election an. The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal level. Its estimated to save New Jersey business owners 200 to 400 million annually.

COVID-19 is still active. However my understanding is that the NJ BAIT payment is deductible as a business expense of the PTE in my case an S-Corp. This law which took effect January 1st 2020 mitigates the impact of the federal 10000 state and local tax SALT deduction cap imposed as part of the Tax Cuts.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. 24000 400K x 6 The NJ BAIT tax deducted at entity level would be added back to taxable earnings for the calculation of NJ income tax. Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M.

Returns due between March 15 2022 and June 15 2022 are due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments. February 23 2022 226 AM. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax SALT deduction cap.

The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year. Thanks very much for your reply. The owner may then claim a refundable tax credit on their return for the amount of tax paid by the.

Stay up to date on vaccine information. The following BAIT due dates have been extended from Mar. You can only use the NJ Pass-Through Business Alternative Income Tax PTE Online Filing and Payments.

The election must be made before March 15 2021 for calendar. If a pass-through entity wishes to credit all or a part of its 2021 PTE-100 overpayment to. This enables the business owner to deduct their New Jersey income taxes as a business expense and therefore avoid the 10000 SALT cap.

Since the passage of the legislation the NJ Division of Taxation has created and updated its Frequently Asked Questions which contain general information about the BAIT as well as information on making the election making estimated tax payments and calculating the tax. Unfortunately the law as originally. A pass-through entity must file a BAIT Election prior to making a BAIT payment or filing a BAIT return.

Tax Prager Metis Jan 28 2022. If the sum of each members share of distributive proceeds attributable to the pass-through entity is. BAIT Credit on NJ Tax Return.

54A1-1 et seq in a taxable year. The New Jersey Division of Taxation has provided answers to several recent questions about the New Jersey Business Alternative Income Tax BAIT. New Jersey joined the SALT workaround bandwagon this year by establishing its Business Alternative Income Tax BAIT.

The NJ BAIT tax payment is made by SCorp after registering at NJ Pass Thru BAIT. The NJ BAIT 2022 will also allow partnerships that make payments to apply those payments to upper-tier non-individual entities. This information has been posted to the New Jersey Division of Taxations website.

The entity must have at least one member who is liable for tax on their share of distributive proceeds pursuant to the New Jersey Gross Income Tax Act NJSA. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax SALT deduction cap.

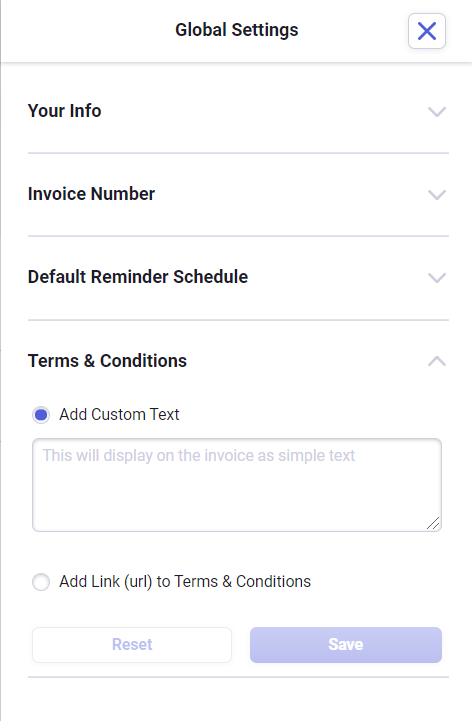

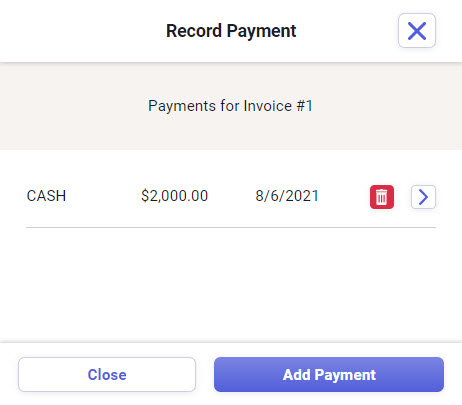

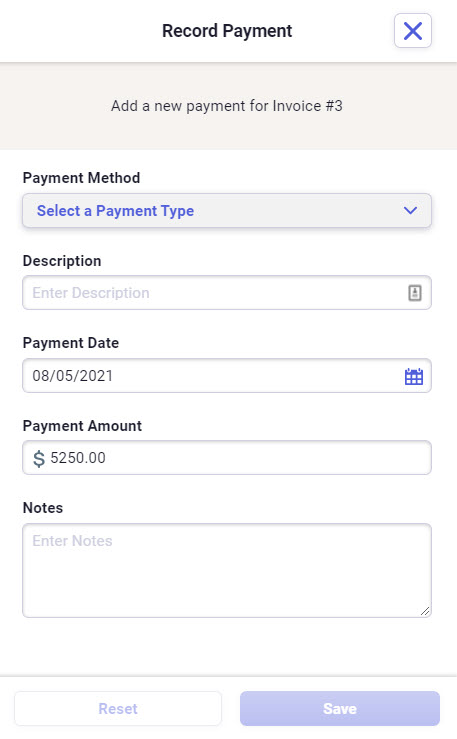

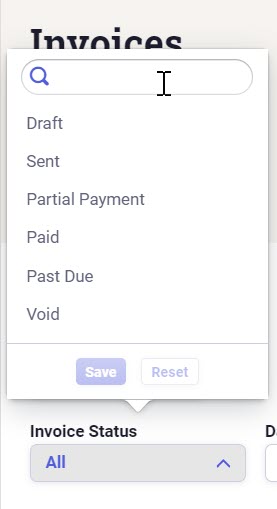

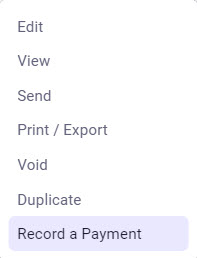

Invoicing Basics In Neat Neat Helpcenter

Invoicing Basics In Neat Neat Helpcenter

Invoicing Basics In Neat Neat Helpcenter

Invoicing Basics In Neat Neat Helpcenter

Invoicing Basics In Neat Neat Helpcenter

Invoicing Basics In Neat Neat Helpcenter

Mr Cooper Nationstar Faces Class Action Over Thousands Of Unauthorized Mortgage Payments Top Class Actions

Nj Tax Revenues Up 15 2 For January And 21 7 For Fy2022 Njbia

Invoicing Basics In Neat Neat Helpcenter

Two Million More People Paying Higher Rate Tax

Hawaii Lawmakers Approve Payments Of Up To 300 For Taxpayers Polarbear Newsbreak Original

Nj Salt Work Around Pass Through Entity Tax

Dental Insurance 101 In 2022 Dental Insurance Plans Dental Insurance Dental Coverage

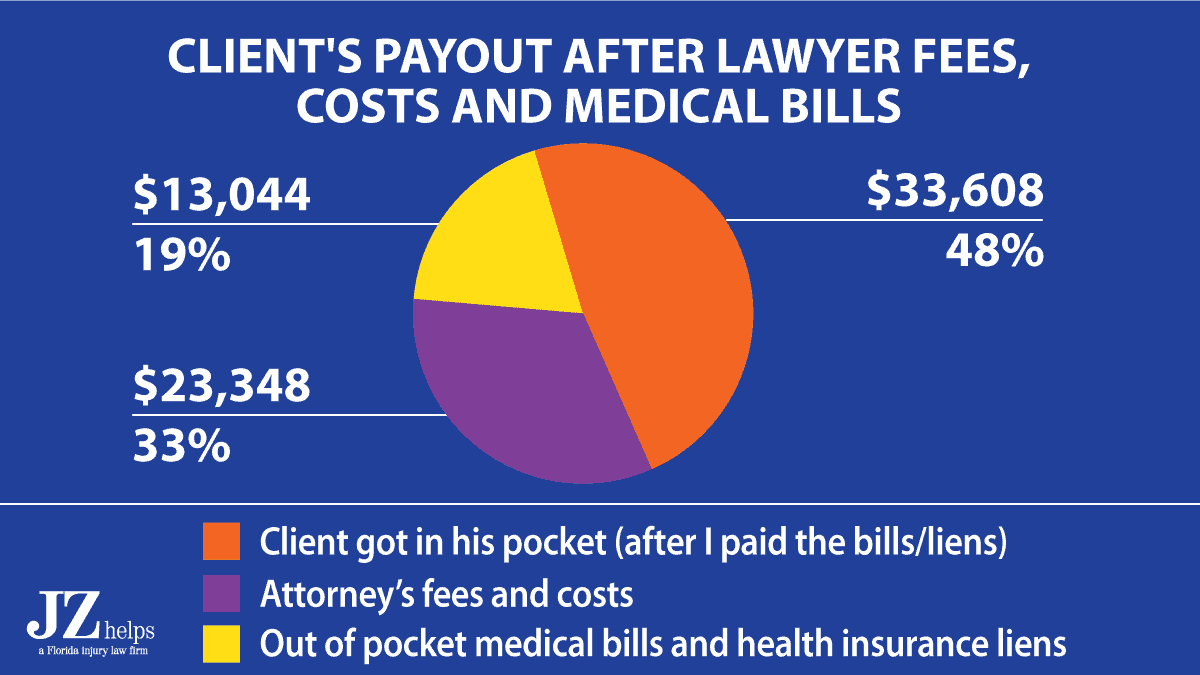

Geico Car Accident Settlement Amounts And Claims In 2022

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

Used Toyota Highlander For Sale In Yonkers Ny Edmunds

New 2021 Lexus Rx 350 Near Highland Park Il Lexus Of Highland Park